The home textiles market is on a growth trajectory as people are now, especially since COVID-19, more interested and willing to spend on home decor. To cater to this demand, manufacturers are coming out with innovative products, which are only likely to enhance the quality of all items—from bed linen to curtains.

The home textiles market has emerged as a major segment in the textile sector as its growth is constantly being supported by growing household income, increasing population, and rising income levels. The global home textiles market was valued at $193.48 billion in 2021 and is expected to propel at a compound annual growth rate (CAGR) of 5.6 per cent from 2022 to 2030. Home textiles include bed and bath linen, kitchen and table accessories, carpets and rugs, curtains, and other items used for interior decoration. Manufacturers of these items have been constantly innovating in terms of designs, styles, quality, patterns, and products to attract more consumers. Due to the twin factor—the shifting home furnishings trends and the current popularity of home textile products—the global home textiles market is expected to witness a fast-paced growth.

Though COVID-19 was a big threat to several businesses globally, it turned out to be a golden period for home textiles as spending on home furnishing goods leapt remarkably to record highs. Because of the lockdowns, people were forced to stay indoors which generated an urge to transform their homes. As a result, home textile products experienced a robust demand during the pandemic. Ever since then, households across the globe are going through a massive makeover. It can be said that in home textiles what was yesterday’s benchmark of luxury has now become a necessity. In fact, the idea of home has become more eclectic and aspirational combined with comfort, avant-garde convenience, cleanliness, and hygiene. These factors have propelled a sharp surge in demand for home furnishing products, and the demand momentum is expected to sustain in 2023.

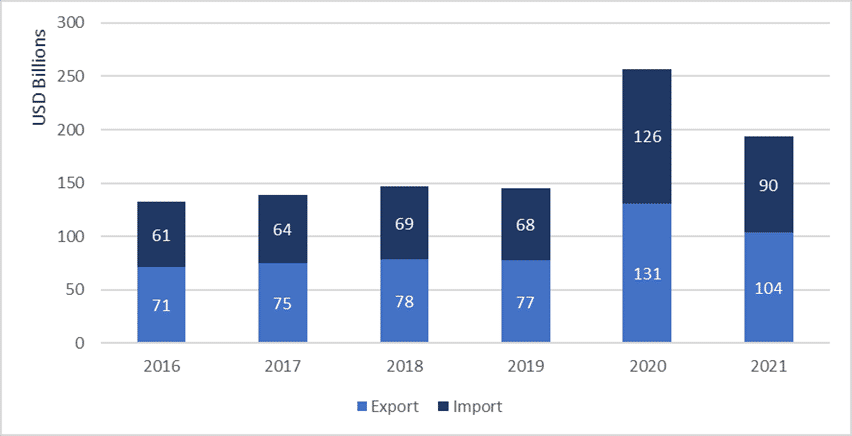

Figure 1: Import and export statistics of the home textiles market

Source: TexPro

Trade

Exports: The year 2021 saw global export worth $780.98 billion of textile and apparel commodities, which is a direct annual growth of over 15 per cent from the previous year’s $677.80 billion. The overall growth was reflected in the home textiles segment as well, increasing the global export from $77.10 billion in 2019 to $103.91 billion in 2021. Home textiles account for over 13 per cent of the total textile and apparel export. The growth in the trade of home textiles in the last two years could be credited to the growth in the demand for bed and bath linen, carpets, blankets, curtains, and other furnishing segments. Demand for home textiles has mostly peaked in developed economies in Europe and North America. However, demand growth in emerging markets is expected to increase significantly as disposable income growth facilitates a shift to more luxury spending, due to which the home textile export is projected to expand at a CAGR of 6.76 per cent during 2022-2026.

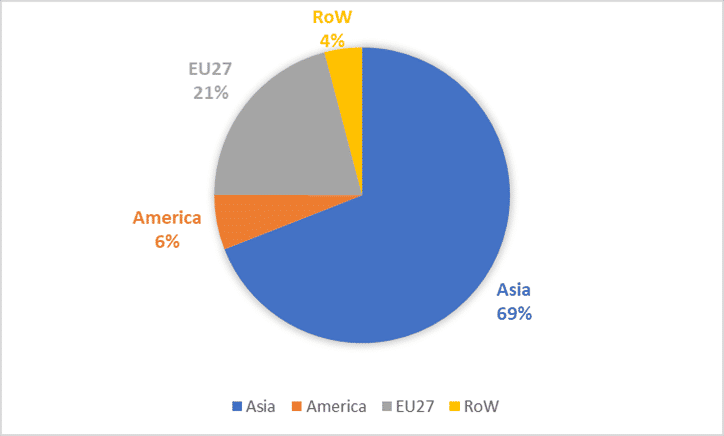

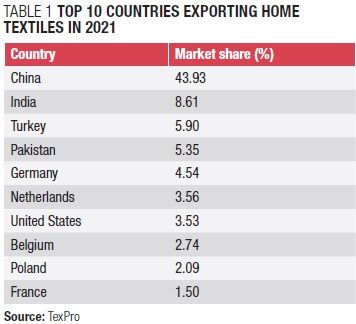

The global home textiles market can be divided into four regions: Asia, America, the European Union, and the Rest of the World (RoW). A regional analysis of exports shows that Asia holds a 69 per cent share in the global home textiles trade. Europe, North America, and RoW held market shares of 21 per cent, 6 per cent, and 4 per cent respectively in 2021. Globally top ten home textiles exporting countries accounted for more than 80 per cent of the worldwide export in 2021, led by China with a market share of 43 per cent.

In the coming years too, the Asian region is expected to dominate the global home textiles market due to the abundance of labour, raw material etc. China, which has the world’s largest textile industry in terms of overall production and exports, is expected to hold a significant share in the home textiles market.

Figure 2: Top exporters of home textiles in 2021 (region-wise)

Source: TexPro

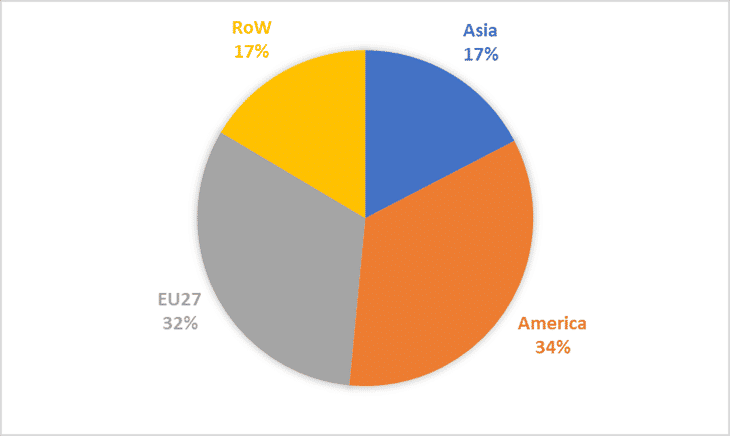

Figure 3: Top importers of home textiles in 2021 (region-wise)

Source: TexPro

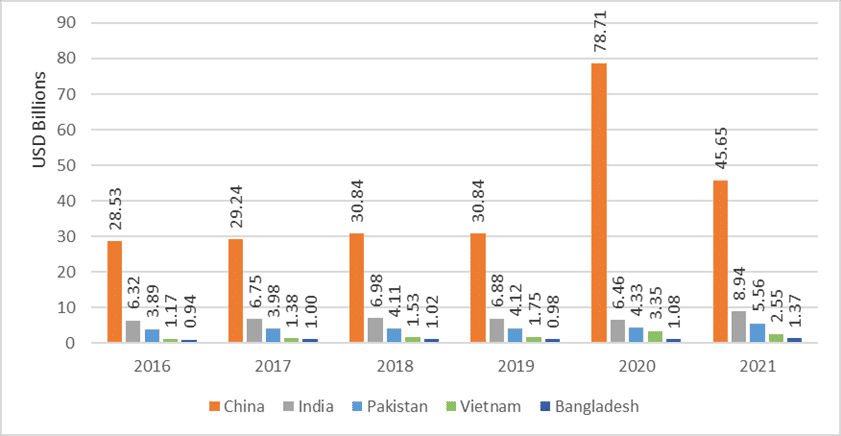

China’s home textile exports soared to $78.624 billion in 2020 from $32.578 billion in 2019, but they dropped to $45.555 billion in 2021. China exported $35.43 billion of home textiles in the first ten months of 2022. According to Fibre2Fashion’s market insight tool TexPro, bed, table and toilet linen contributed $8.09 billion (22.83 per cent) in total home textiles exports from China during January-October 2022. The export earnings from other major home textile products were blankets $3.72 billion (10.50 per cent), curtains $2.42 billion (6.83 per cent), carpets $3.22 billion (9.09 per cent), and furnishing articles $2 billion (5.64 per cent).

Meanwhile, India exported $8.94 billion worth of home textiles in 2021, a 38 per cent jump from $6.46 billion in 2020. India exports silk, coir, jute, and handloom carpets and floor coverings. The country exports about 85-90 per cent of the total carpets it produces and is one of the largest exporter in the world. India is responsible for around 40 per cent of worldwide export of handmade carpets. India’s handmade carpets and other floor coverings export recorded a growth of 19.5 per cent to reach $2.23 billion in 2021-22. Since 2017-18, carpet exports from India have witnessed a CAGR of 7 per cent. In the first nine months of 2022, carpet exports from the country were valued at $1.5 billion, compared to 2020 figure of $1.119 billion.

According to the data from Export Promotion Bureau (EPB) of Bangladesh, the home textile exports earned $268.52 million for the country during July to August of the current fiscal year (FY23), registering an annual growth of 53.39 per cent over $175.06 million in the same period of FY22. Home textiles was the second main export income earner for the country, next to readymade garments, in both the last fiscal year and the first two months of FY23.

Figure 4: Top Asian countries exporting home textile products

Source: TexPro

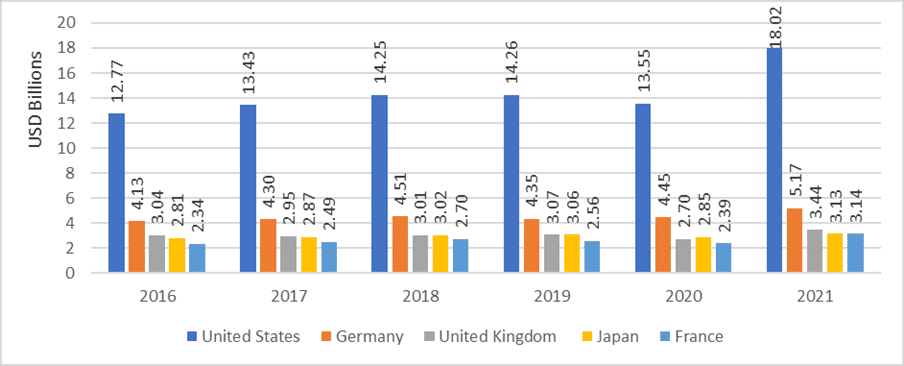

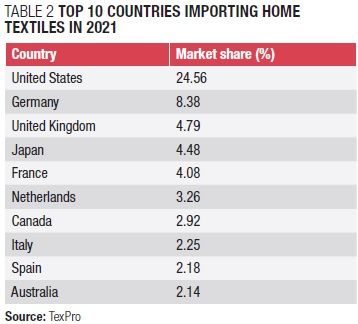

Imports: Home textiles sales in the United States remained more dominant compared to any other country and picked up dramatically in 2021, when imports grew by over 33 per cent YoY to $18.02 billion. US imports of home textiles have continued to grow despite the impact of the economic challenges on discretionary expenditure globally. The imports grew by 1.62 per cent to $16.05 billion in the first ten months of 2022, compared to $15.80 billion in the same period of 2021. With a 47.17 per cent share, China continues to be the largest supplier of home textiles to the US, followed by India with 19.11 per cent and Pakistan with a 7.69 per cent share.

Figure 5: Top importers of home textiles over the years

Source: TexPro

Figure 6: Product-wise imports of home textiles

Source: TexPro

Source: TexPro

In several other countries too, the demand for home textiles grew tremendously in 2021. The global imports in 2021 were up by 32 per cent YoY and were valued at $89.57 billion compared to $68.27 billion in 2019.

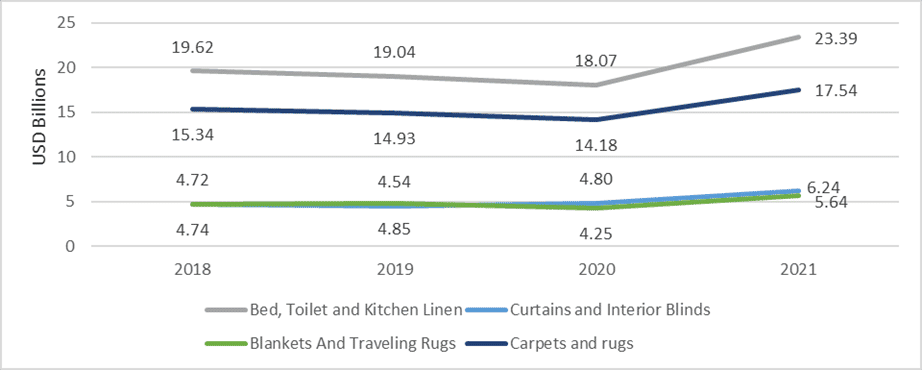

Segment-wise performance: In terms of product category, goods that cater primarily to home decor have seen tremendous growth over pre-pandemic levels. For instance, exports of bed, table and bath linens in 2021 reached $23.39 billion compared to $18.07 billion in the same period of 2020 registering a 29.44 per cent YoY jump. On the other hand, blankets & travelling rugs saw exports grow to $5.64 billion in 2021 from $4.85 billion in 2019. Curtains & blinds, another key category of home decor, saw exports grow much faster in 2021 than in 2020. Exports of curtains & blinds in 2021 were at $6.24 billion, up by 37.44 per cent compared to $4.54 billion in 2019. As per TexPro, the market size of the flooring segment of home textiles was estimated at $32.42 billion in 2021, a 16.96 percent growth from $27.72 billion in 2019.

The increasing awareness and the rapid growth in online retail sales of bed and bath linen products have amplified the competition in the market. In 2021, the bed, table and bath linen segment led the home textiles market, accounting for approximately 32 per cent share. The bed linen segment is expected to experience high growth, due to the rising demand for designer bed linen with multiple functional benefits. This segment has the highest CAGR of approximately 7.38 per cent and is expected to grow substantially and reach over $125 billion by 2026 as there would be a growing readiness to invest in products that provide more relaxing and refreshing experiences.

Trends

The market for home textiles is extensive and diverse in terms of prices, designs, as well as colours. Post- COVID, the demand for better quality, antimicrobial, stain-resistant, and flame-retardant home textiles is increasing. Meeting this challenge head-on, manufacturers today are trying a variety of fabrics including silk, polyester, velvet etc to develop newer products. Some prominent home textiles manufacturing brands have also started making products using natural fabrics such as hemp, banana, soya and bamboo. Currently, however, cotton, due to its great softness and absorbent properties, is the most used raw material in the manufacturing of bed and bath linen products, such as bed sheets, pillowcases, towels and duvet covers. Cotton is also preferred due to its durability, comfort and breathability qualities.

Banana home textiles: Banana fabric has a natural shine that replicates real silk and is a great choice for sustainable and eco-friendly textiles. Earlier, the use of banana fibre was limited, as it was primarily used for making mats, ropes, and some composite products. With growing awareness and the rising importance of sustainable products, banana fibres are being increasingly used in manufacturing home furnishings.

Eco-friendly home textile products: These days, diversifying into environmentally friendly home textile products has become an increasingly lucrative business strategy. Manufacturers across the supply chain are developing more sustainable and eco-friendly products made of natural fibres. For instance, Himatsingka unveiled Calvin Klein bedding made from a blend of 65 per cent lyocell fibres and 35 per cent recycled cotton scraps. Pem America introduced its Upcycle brand of recycled materials across bath and show curtains, throws, and bedding, and has added recycled packaging to the licensed London Fog and Crayola brands sold in Canada. It also has developed Christian Siriano brand sheets with recycled cotton that will be sold through Sam’s Club. Welspun India created a new bio-based home textile range, comprising bath towels and bedsheets, in collaboration with DuPont Biomaterials.

One bottleneck to the increasing use of sustainable materials across the home textiles market has been price. It is because sustainable textile products come at a premium of 15-20 per cent. However, a transition to a sustainable textiles industry would have massive social, economic and environmental benefits. According to the Ellen MacArthur Foundation and McKinsey, the shift to a sustainable, circular economy would help recapture more than €400 billion in industry losses each year and still alleviate negative environmental impacts. The EU believes the transition to a sustainable, circular economy will stimulate competitiveness, innovation, economic growth, and employment.1 Therefore, a fully transparent circular economy is the foundation of Europe’s strategy to minimise the negative impacts of the textile industry. EU is targeting a closed-loop system in which apparel, textiles, home textiles etc will retain their value for as long as possible and waste is minimised. This requires strategies such as recycling, reusing, and rethinking the lifecycle of textile products.

Antimicrobial textiles: Rising infectious diseases have pushed the demand for antimicrobial textiles across the home furnishing industry. The demand for antimicrobial textiles is rising due to the increased awareness about hygiene, rising disposable income, changing lifestyles along with increased concern about health and the environment. Antimicrobial textiles form a barrier against bacteria responsible for odour and skin infection. Plus, antimicrobial treatments are cost-effective and easy to implement in textile production. With antimicrobial additives, textile products ensure protection against a wide variety of pathogens. Hence, they are being widely used, among others by nonwoven bedding manufacturers.

In addition, retailers have also started launching home textiles and bedding products that block allergens. Among other antimicrobial home textiles, innovative carpets are gaining traction. While normal carpets provide comfort, they can accumulate dust and smell quickly. In contrast, carpets produced with antimicrobial material help prevent unpleasant smells as they contain chemical components that soak and get rid of the odour. They are also easy to clean, germ-free, and long-lasting. Moreover, the odour-neutralisation property of these carpets does not get reduced by cleaning or washing.

Use of nanotechnology: The quality of bedsheets can have a substantial impact on people’s sleep. Some bedsheets can remain cool in summer, thanks to modern techniques of home textiles manufacturing. These bedsheets manufactured with the help of nanotechnology enhance many qualities such as odour resistance, breathing ability, and moisture resistance. Combined with moisture-absorbing technology, they help control body temperature while sleeping.

Innovative curtains: Lately, various types of new curtains such as solar curtains, automatic curtains, and magnetic curtains are available in the market. Solar curtains work on solar energy and help to keep the sun’s heat out of the room. They do not impede the outside view and balance the room temperature during summer. A few solar panels are located on the terrace that convert heat into power which helps to maintain the temperature of the room.

Magnetic curtains, developed by the innovative home textiles industry, can acquire any shape and remain in that state. It is because they contain numerous tiny magnets on their surface. Little magnets are placed in a specific way so that they can retain their structure with just one force applied. Magnetic curtains are flexible because they can adopt any form, plus they are long-lasting and require little care.

Automated curtains are controlled digitally. Anyone can slide these curtains with a single click of a button. Likewise, there are fire-retardant curtains available that are used for fire safety. Automated curtains are mostly produced with innovative fire-resistant materials with nylon and stainless steel wires.

Conclusion

The increasing population and rising per capita income of the people have together propelled the global home textiles market. The rise in the number of nuclear families, rapid industrialisation and urbanisation, and a surge in sensibility towards aesthetic household furnishing are the other factors that are contributing to increase in demand for home textiles and furnishing products.

Recognising the high demand and growing consumer awareness, several companies are investing extensively in their home textiles business. They are applying the latest techniques for faster development of products and thereby meet an increasing number of consumers’ demands. Going forward, the quality of home textile products is likely to become better due to adoption of latest technologies and production techniques.