There are a few important trends to glimpse for if we want to establish the next multi-bagger. Ideally, a small business will exhibit two developments first of all a developing return on capital utilized (ROCE) and secondly, an rising sum of funds employed. Basically this means that a corporation has worthwhile initiatives that it can go on to reinvest in, which is a trait of a compounding machine. With that in mind, we have observed some promising traits at Nafpaktos Textile Industry (ATH:NAYP) so let us search a bit deeper.

Return On Funds Used (ROCE): What Is It?

If you have not labored with ROCE ahead of, it actions the ‘return’ (pre-tax profit) a enterprise generates from funds used in its organization. To calculate this metric for Nafpaktos Textile Field, this is the components:

Return on Capital Utilized = Earnings Before Curiosity and Tax (EBIT) ÷ (Full Property – Recent Liabilities)

.14 = €2.3m ÷ (€21m – €3.9m) (Based mostly on the trailing twelve months to June 2022).

Consequently, Nafpaktos Textile Industry has an ROCE of 14{5e37bb13eee9fcae577c356a6edbd948fa817adb745f8ff03ff00bd2962a045d}. That is a pretty typical return and it really is in line with the market typical of 14{5e37bb13eee9fcae577c356a6edbd948fa817adb745f8ff03ff00bd2962a045d}.

See our most recent analysis for Nafpaktos Textile Marketplace

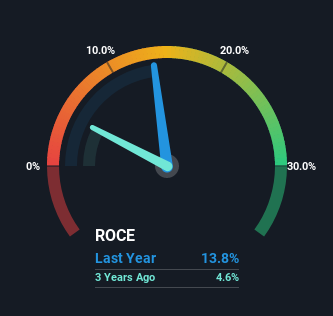

Historical performance is a fantastic area to start out when exploring a inventory so previously mentioned you can see the gauge for Nafpaktos Textile Industry’s ROCE versus it can be prior returns. If you want to delve into the historic earnings, earnings and hard cash movement of Nafpaktos Textile Sector, test out these totally free graphs here.

What Can We Tell From Nafpaktos Textile Industry’s ROCE Pattern?

Investors would be happy with what is actually going on at Nafpaktos Textile Field. About the previous five several years, returns on capital employed have risen considerably to 14{5e37bb13eee9fcae577c356a6edbd948fa817adb745f8ff03ff00bd2962a045d}. Generally the enterprise is earning additional for every greenback of money invested and in addition to that, 75{5e37bb13eee9fcae577c356a6edbd948fa817adb745f8ff03ff00bd2962a045d} additional money is getting utilized now as well. So we are very a lot inspired by what we are seeing at Nafpaktos Textile Market thanks to its ability to profitably reinvest cash.

In Summary…

All in all, it truly is marvelous to see that Nafpaktos Textile Marketplace is reaping the rewards from prior investments and is increasing its funds base. And with the inventory acquiring carried out extremely perfectly over the previous 5 decades, these designs are becoming accounted for by traders. So presented the inventory has proven it has promising developments, it is well worth looking into the enterprise even more to see if these tendencies are likely to persist.

Nafpaktos Textile Sector does come with some threats although, we discovered 3 warning signals in our investment decision assessment, and 1 of those people will not sit much too perfectly with us…

For those people who like to make investments in strong organizations, examine out this free list of organizations with reliable harmony sheets and substantial returns on equity.

Valuation is elaborate, but we are encouraging make it straightforward.

Uncover out no matter if Nafpaktos Textile Market is most likely above or undervalued by examining out our thorough analysis, which incorporates reasonable worth estimates, hazards and warnings, dividends, insider transactions and money health.

See the Free Analysis

Have suggestions on this write-up? Anxious about the information? Get in touch with us specifically. Alternatively, e mail editorial-workforce (at) simplywallst.com.

This report by Basically Wall St is common in nature. We provide commentary primarily based on historical facts and analyst forecasts only utilizing an impartial methodology and our content are not meant to be monetary advice. It does not constitute a advice to get or offer any inventory, and does not choose account of your aims, or your economic scenario. We intention to convey you long-expression focused analysis driven by fundamental facts. Note that our analysis might not factor in the newest price tag-delicate firm announcements or qualitative content. Merely Wall St has no posture in any shares talked about.